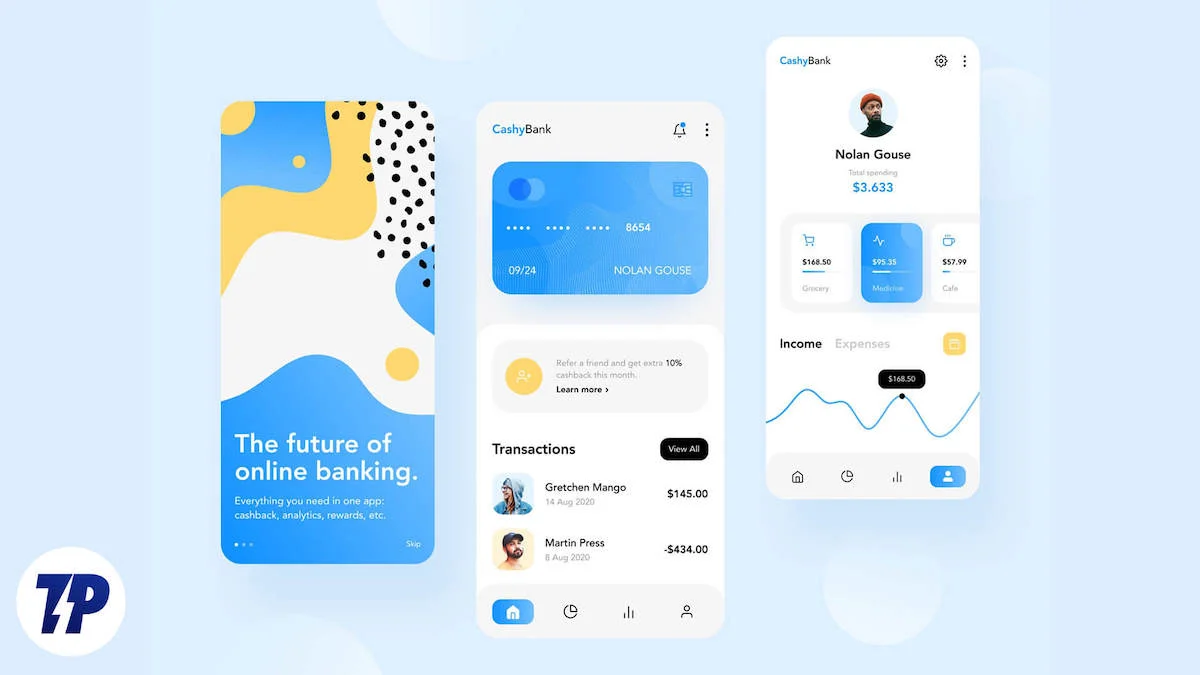

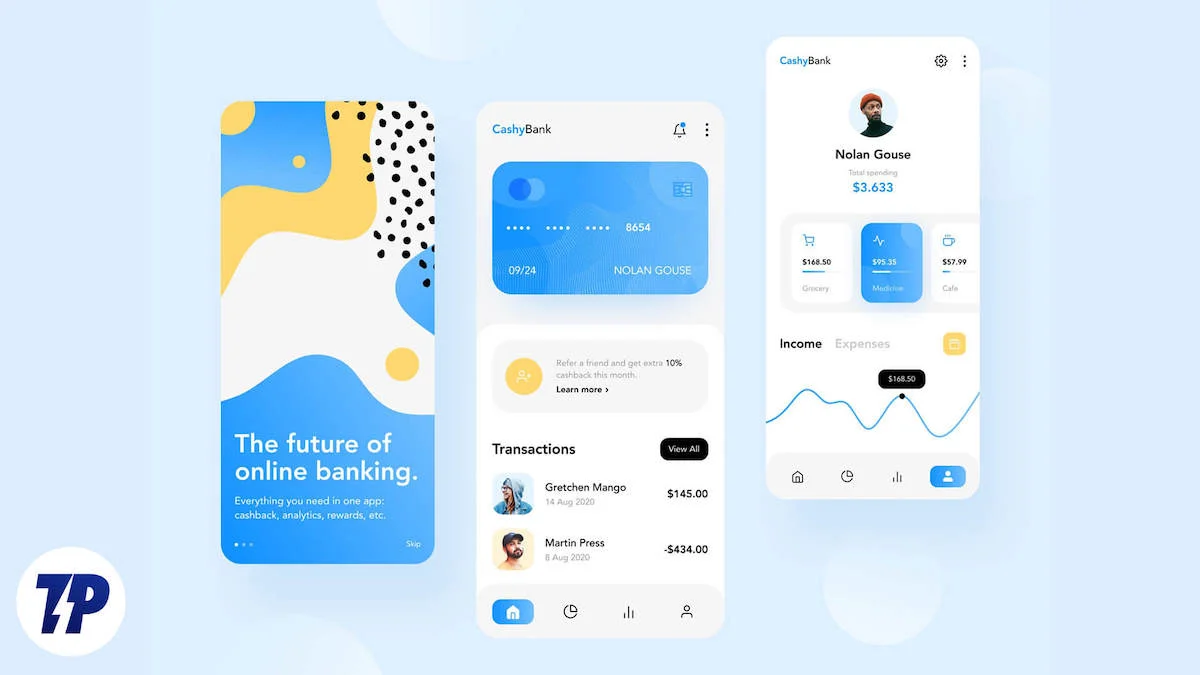

In today’s digital age, managing your finances has never been easier. Finance apps have transformed the way we track income, monitor expenses, create budgets, and set financial goals. These handy tools offer a range of features, from automated expense categorization to detailed spending breakdowns, making it simple to stay on top of your money.

Effortless Expense Tracking

Finance apps take the hassle out of manual record-keeping, a task that’s often tedious and prone to errors. By connecting to your bank accounts, these apps automatically log your transactions, saving you time and ensuring accuracy.

Intelligent Categorization

No more sorting through receipts to categorize expenses. Finance apps use sophisticated algorithms to automatically sort your spending, providing valuable insights into where your money goes.

Budgeting Made Easy

With finance apps, creating and customizing budgets based on your income and spending habits is a breeze. They can even set up alerts to notify you when you’re nearing budget limits, helping you stay on track towards your financial goals.

Goal Setting and Tracking

Whether you’re saving for a dream vacation or a down payment on a house, finance apps can help you visualize and achieve your goals. Set specific targets, track your progress, and make adjustments along the way.

Financial Awareness

Finance apps give you a comprehensive overview of your financial health. With all your data in one place, you can gain valuable insights into your spending patterns, identify areas for improvement, and make informed financial decisions.

Security Concerns with Finance Apps

While finance apps offer numerous benefits, it’s important to be aware of potential security risks.

Data Breaches

Finance apps store sensitive financial information, making them a prime target for hackers. Data breaches can expose your personal and financial data, leading to identity theft and financial losses.

Malware Attacks

Malicious software (malware) can infiltrate your device and steal your financial information. Hackers can use this to make unauthorized transactions or access your bank accounts.

Phishing Scams

Phishing scams trick you into revealing your login credentials or financial information. These scams often come as emails or messages that appear to be from legitimate sources like your bank or finance app provider.

Securing Your Financial Future: Essential Tips

Here are some essential tips to safeguard your financial information when using finance apps:

Choose Reputable Apps

Do your research before downloading a finance app. Opt for apps from well-established companies with strong reputations for security.

Strong Passwords

Use strong and unique passwords for your finance app accounts. Avoid easily guessable information like your birthdate or pet’s name. Consider using a password manager to generate and store complex passwords.

Enable Two-Factor Authentication (2FA)

Whenever possible, enable 2FA for your finance app accounts. This adds an extra layer of security by requiring a second verification code, typically sent to your phone or email, in addition to your password.

Beware of Phishing Scams

Be cautious of emails, text messages, or calls claiming to be from your bank or finance app provider. Never click on links or attachments in such messages, and never provide your login credentials or financial information over the phone or email.

Regular Updates

Keep your finance apps and your device’s operating system updated with the latest security patches. These updates often address security vulnerabilities that hackers can exploit.

Monitor Your Accounts

Regularly monitor your bank and finance app accounts for any unauthorized transactions. Early detection can help minimize financial losses.

Conclusion

Finance apps are powerful tools for managing your finances and achieving your financial goals. However, it’s crucial to be aware of the security risks involved. By following these essential security tips, you can enjoy the benefits of finance apps with peace of mind. Remember, financial security is paramount. Don’t let your budgeting app become a feeding ground for hackers!

FAQs

How do finance apps track my expenses?

Finance apps connect to your bank accounts and automatically record your transactions, saving you from manual entry.

Are finance apps secure?

Many finance apps use advanced security measures, but it’s important to choose reputable apps and follow best security practices.

What should I do if I suspect a data breach?

Immediately change your passwords, monitor your accounts for unauthorized transactions, and contact your bank and the app provider.

Can finance apps help me save money?

Yes, finance apps can help you create budgets, track spending, and set financial goals, all of which can aid in saving money.

Do I need to pay for finance apps?

There are both free and paid finance apps available. Paid apps often offer additional features and enhanced security.

How do I protect myself from phishing scams?

Be cautious of unsolicited messages, avoid clicking on links or attachments, and never share your login credentials via email or phone.

Midday Market Movers: Paramount, Morphic, and Ideaya Surge on Positive News

MORE MUST-READS FROM liveupdatechannel

To get all the Updated news, Stay in touch with the liveupdatechannel here