Protecting Your Home with Travelers Homeowners Insurance

Your home is one of your most valuable possessions, and Travelers homeowners insurance can help protect it from various risks. This guide will provide all the information you need to understand and secure a Travelers homeowners policy, from application methods to detailed coverage options and potential savings.

Getting Started: Applying for Travelers Homeowners Insurance

Online Application

Applying for Travelers homeowners insurance online is simple. By visiting Travelers’ website, you can quickly input your address and basic details to receive an initial quote. The online system is user-friendly and allows you to compare different coverage options easily.

Phone Application

Prefer to speak with someone directly? Call Travelers at 1-844-403-1464. A representative can guide you through the application process, answering any questions you might have and helping you understand your coverage options.

Independent Agents

Travelers also works with a network of independent insurance agents. These agents can offer personalized assistance and help you find the best policy for your needs. You can find an agent in your area through the Travelers website.

Understanding Your Coverage

Dwelling and Structure Coverage

This part of your policy covers the physical structure of your home, including the walls, roof, and foundation. It protects against damage from fire, wind, hail, and other covered perils.

Personal Property Coverage

Your belongings inside the home are also protected. If your items are stolen or damaged by events like fire or theft, personal property coverage can help replace them.

Liability Coverage

Liability coverage provides financial protection if someone is injured on your property and decides to sue you. It covers legal fees and any resulting settlements or judgments.

Additional Coverages

Travelers offers optional coverages like identity theft protection and coverage for valuable possessions such as jewelry and artwork. These additional coverages ensure that specific high-value items are adequately protected.

Advantages and Disadvantages of Travelers Homeowners Insurance

Advantages

- Reputation: Travelers is a well-established company with strong financial backing, ensuring reliability and trustworthiness.

- Customization: A variety of coverage options allow you to personalize your policy to fit your specific needs.

- Additional Services: Travelers provides resources for risk management and claims assistance, adding extra value to their policies.

Disadvantages

- Cost: Depending on factors like location, dwelling value, and coverage needs, Travelers might not be the cheapest option available.

- Availability: Coverage might not be available in all areas, limiting accessibility for some homeowners.

Standard Cost

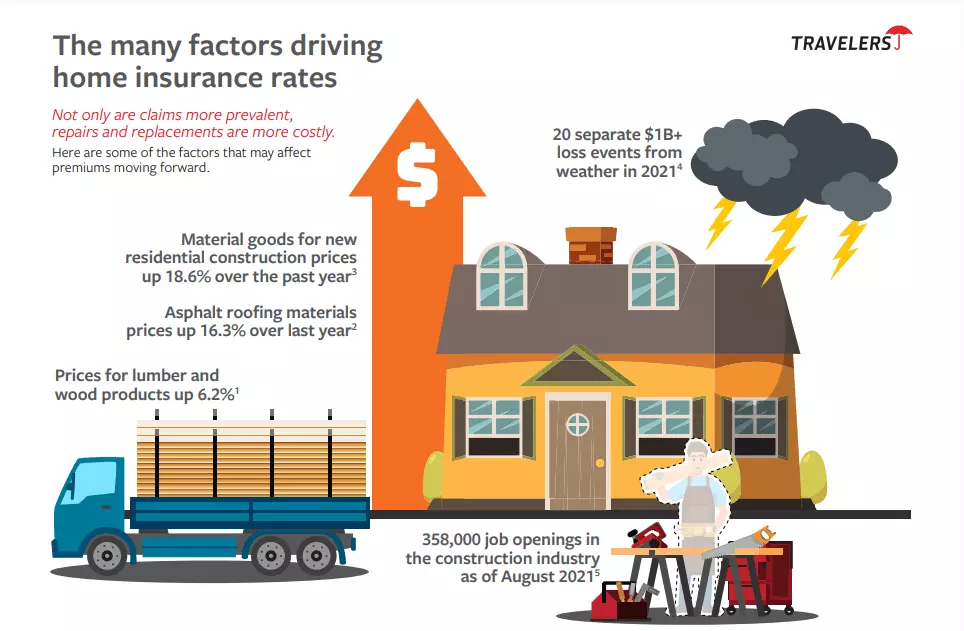

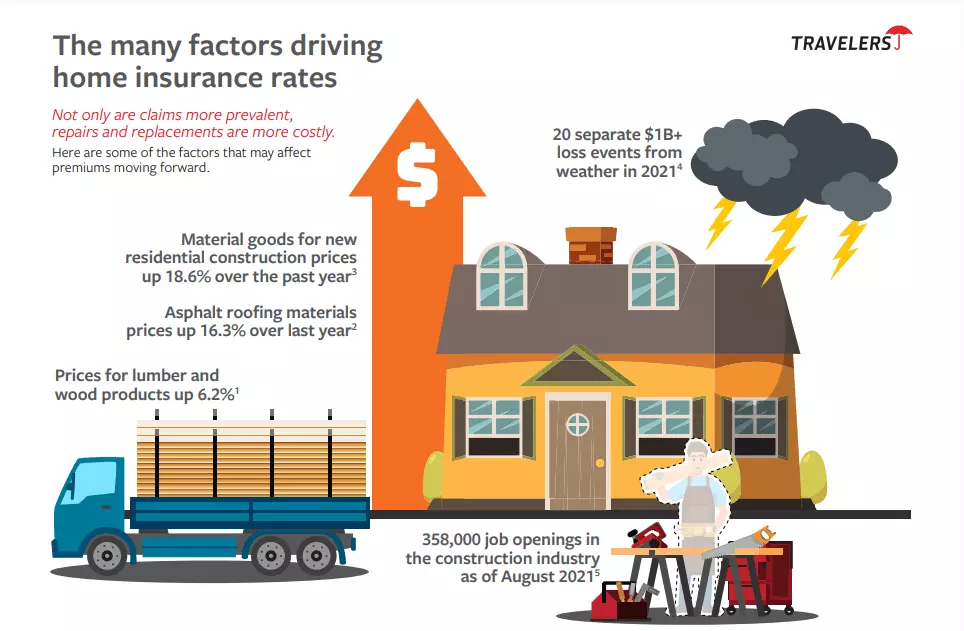

Factors Affecting Cost

- Location: The location of your home significantly impacts the cost of your premium. Areas prone to natural disasters or high crime rates typically have higher insurance costs.

- Dwelling Value: The higher the replacement cost of your home, the more expensive the coverage will be.

- Coverage Options: The specific coverages you choose will affect the overall premium.

- Deductible: Opting for a higher deductible can lower your premium but means you’ll pay more upfront in the event of a claim.

Discounts

Types of Discounts

Travelers offers several discounts to help you save money on your homeowners insurance:

- Multi-policy Discount: Bundling your home and auto insurance with Travelers can lead to significant savings.

- Security System Discount: Having a monitored security system can reduce your premium.

- Claims-Free Discount: Maintaining a claims-free history can earn you a discount, rewarding you for not making claims.

The Takeaway

Travelers homeowners insurance offers comprehensive coverage options backed by a reputable company. Their policies can be customized to meet your specific needs, and they provide additional resources and discounts to help manage your costs.

Next Steps

Comparing Quotes

To ensure Travelers is the right fit for you, it’s wise to compare quotes from multiple insurance providers. This allows you to see what other companies offer and how their rates compare to Travelers.

Decision Making

Consider your specific needs, budget, and the level of coverage you desire before making a final decision. Evaluating these factors will help you choose the best homeowners insurance policy for your situation.

MORE MUST-READS FROM liveupdatechannel

FAQs

What does Travelers homeowners insurance cover?

Travelers homeowners insurance covers the physical structure of your home, personal property, and provides liability protection. Additional coverages like identity theft protection and valuable possessions coverage are also available.

How do I apply for Travelers homeowners insurance?

You can apply online via the Travelers website, over the phone by calling 1-844-403-1464, or through an independent insurance agent.

What factors affect the cost of Travelers homeowners insurance?

The cost is influenced by your home’s location, its replacement value, the coverage options you choose, and your deductible amount.

Are there discounts available with Travelers homeowners insurance?

Yes, Travelers offers discounts for bundling policies, having a security system, and maintaining a claims-free history.

Is Travelers homeowners insurance available nationwide?

Travelers homeowners insurance is available in many areas, but it might not be offered everywhere. It’s best to check their website or contact an agent to confirm availability in your area.

Can I customize my Travelers homeowners insurance policy?

Absolutely. Travelers offers a variety of coverage options that allow you to tailor your policy to fit your specific needs.

Conclusion

Travelers homeowners insurance provides comprehensive coverage options, competitive discounts, and the backing of a reputable company. By understanding the application process, coverage details, and available discounts, you can make an informed decision to protect your home effectively.