Déjà Vu in China? Lessons from Japan’s Revival for Today’s Chinese Stocks

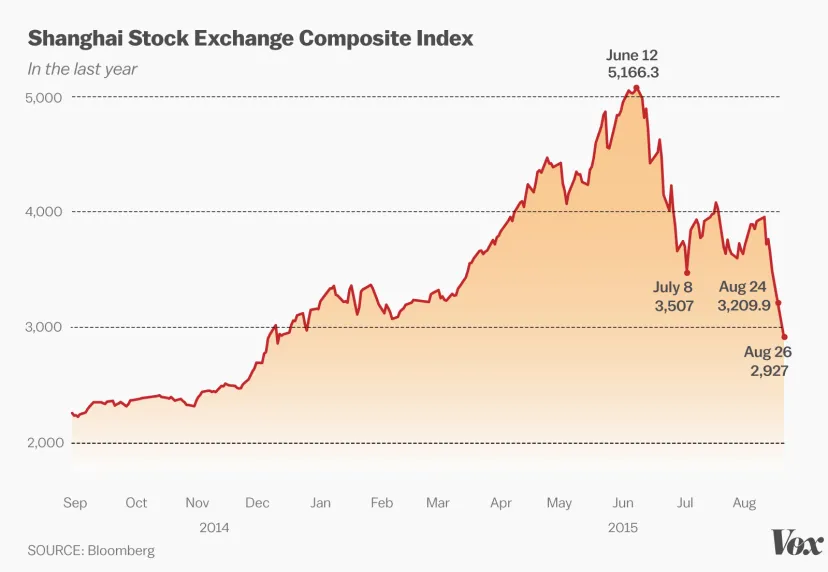

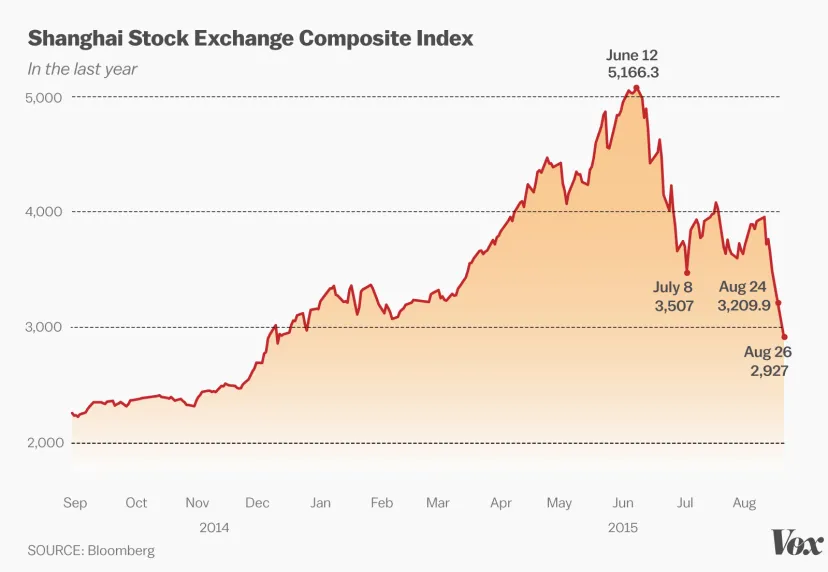

The Chinese stock market has been in the news recently, with analysts speculating about “significant upside potential.” This feeling is uncannily similar to what happened in the early 2010s, when the Japanese stock market began to rise again following years of stagnation. Is China going in the same direction? Can investors profit from this possible boom? is the question on everyone’s mind.

Learning from Japan’s Abenomics:

China can learn a lot from Japan’s Abenomics economic revitalization plan. When Abenomics was introduced in 2013, its three main objectives were to:

Aggressive monetary policy: In order to lower interest rates and promote investment, the Bank of Japan introduced quantitative easing (QE), which flooded the market with cash.

Fiscal stimulus: To stimulate the economy, the government spent more on social programs and infrastructure.

Structural reforms: The goal of Abenomics was to enhance corporate governance and deregulate the economy in order to attract international investors to Japan.

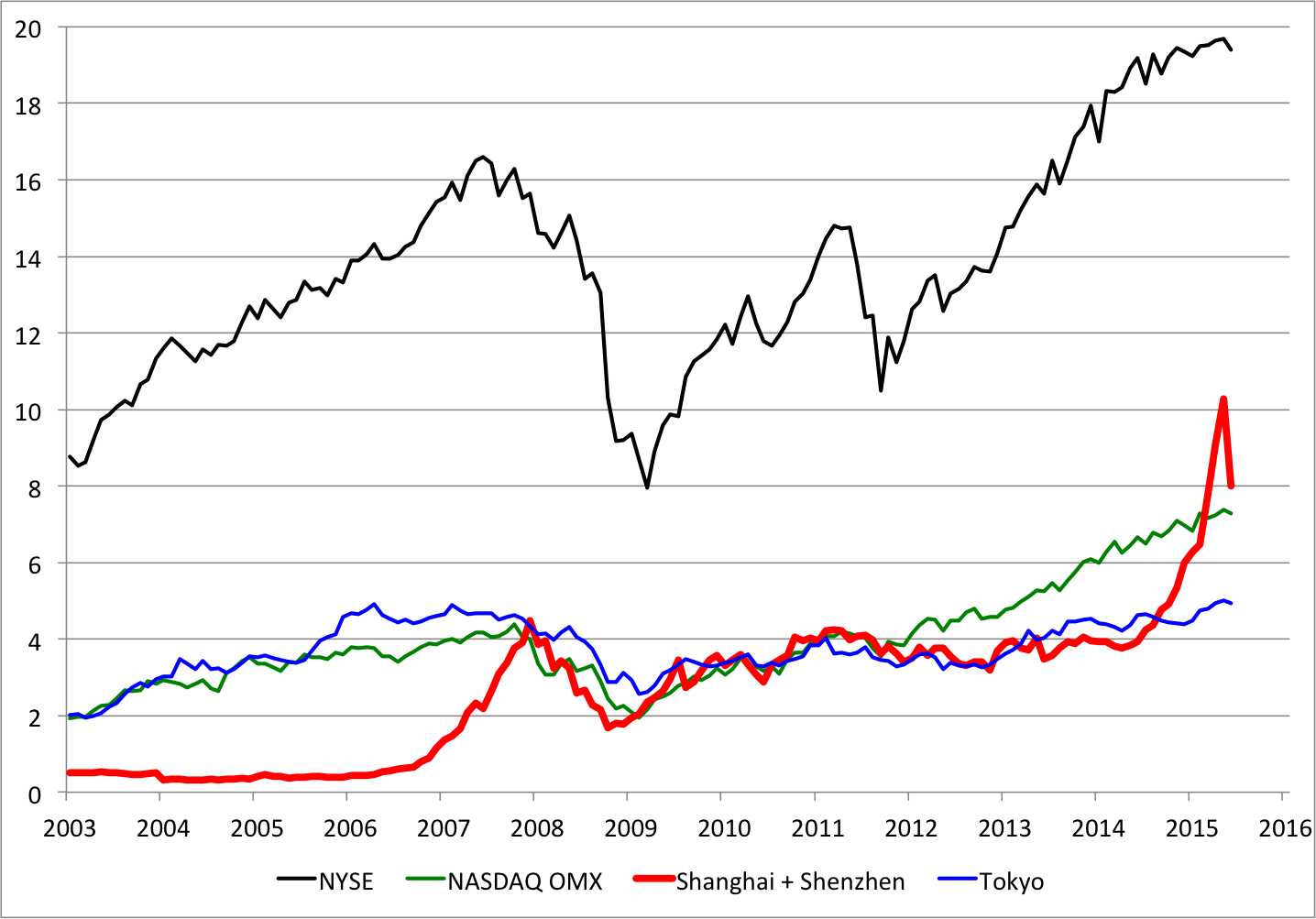

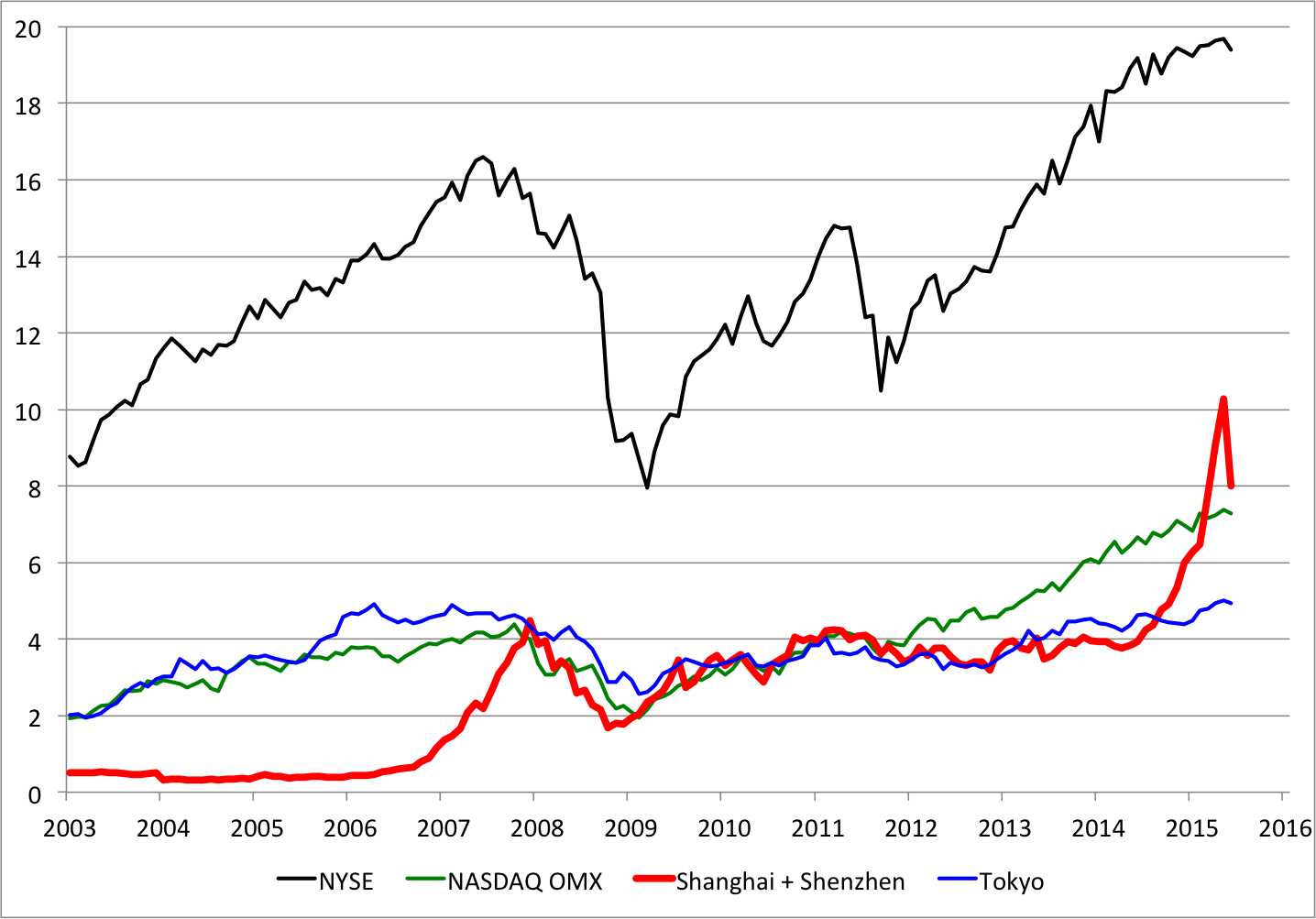

Abenomics saw some significant accomplishments even though its outcomes were mixed. Between 2012 and 2015, the Nikkei 225 index more than doubled, indicating a major rally in the stock market. Japan emerged from a period of deflation, and corporate profits increased.

China’s Echoes and Divergences:

Abenomics and China’s present economic policies are not entirely dissimilar. Through interest rate reductions and banking system liquidity injections, the government is relaxing monetary policy. To support economic activity, there is also a need for higher infrastructure spending.

But there are also some significant variations. China is enforcing more control over some industries, such as technology and education, in contrast to Japan’s emphasis on deregulation. China’s aging population also presents a bigger demographic concern.

Upside Potential for Chinese Stocks?

China’s stock market is expected to have a big surge, considering the differences. This is the reason why:

Undervaluation: Many Chinese enterprises are lowly valued in relation to their international counterparts. This can offer investors looking for long-term gain an enticing entry point.

Support from the Government: To preserve stability and promote expansion, the Chinese government has a proven track record of getting involved in the stock exchange. This might offer investors a safety net.

Focus on Innovation: China is allocating significant funds to technical innovation, which may support future economic expansion and present business opportunities for investors in particular industries.

But It’s Not All Sunshine and Rainbows:

Before diving in headfirst, be aware of the following risks:

Geopolitical Tensions: The US-China trade war and other geopolitical issues may sour investor mood and hinder economic expansion.

Debt Concerns: The financial system may be at risk due to China’s high levels of consumer and business debt.

Investing in China: A Calculated Move

There is no denying the potential for Chinese stocks to rise. A long investing horizon and rigorous risk assessment are essential, though. The following advice can help you navigate the Chinese market:

Diversify: Avoid putting all of your money in one place. To reduce risk, distribute your assets among several industries and asset types.

Focus on Fundamentals: Seek out businesses with solid financials, competent leadership, and a defined expansion strategy.

Seek Professional Guidance: To ensure that your investing decisions are well-informed, think about speaking with a financial advisor with knowledge in the Chinese market.

The Takeaway: A Promising Future, But Proceed with Caution

The stock market in China has the capacity to follow Japan’s post-Abenomics boom. Investors should be conscious of the particular dangers, though. Through careful research and a careful balance of possible rewards and dangers, investors can position themselves to take advantage of China’s potential growth narrative. Don’t forget that smart judgments should be made based on a thorough grasp of the industry, not just by blindly following trends.

7 Tony Tears & 1 Yellow Croc: Emotional Wins & Bold Choices at the 2024 Tony Awards

MORE MUST-READS FROM liveupdatechannel

To get all the Updated news, Stay in touch with the liveupdatechannel here